//7 min

Despite current global economic challenges, investment in the fintech sector has skyrocketed in the past two years and is predicted to reach $124.3 billion USD by 2025. And as the industry grows, so does the need for outsourcing. According to a 2021 report by Moorwand, 49% of fintechs spend 10-20% of their annual revenues on outsourcing, making choosing a suitable partner a crucial business decision.

Vicki Gladstone, CEO and COO at Moorwand, explains this perfectly:

“For a long time, the fintech sector was characterized by the idea of disruption and competition. As the industry matures...focus has shifted to collaboration to drive growth"

Getting the balance between build-versus-buy right is a challenge for all businesses, including fintechs. The industry commonly outsources services such as card issuing, mobile wallet, and customer communications, and looks for partners that can assist in application, web, and product development, software maintenance, cybersecurity, and cloudification.

At intive, we prefer the more collaborative term “partnership” instead of “outsourcing”.

So, if you’re contemplating partnering up, let’s explore a few of the reasons why your fintech may benefit from a tech third-party collaboration and what factors to look out for when choosing one.

Fill in the Expertise Gaps

Firstly, be critical about the strengths and weaknesses of your fintech business and accept that another company may be able to do what you’re attempting to do better. By better, we mean faster, more cost-effective, or perhaps it has a bigger wealth of experience to draw on. Perhaps they can offer you something that your business simply doesn't have the remit for altogether, such as a certain specialized service.

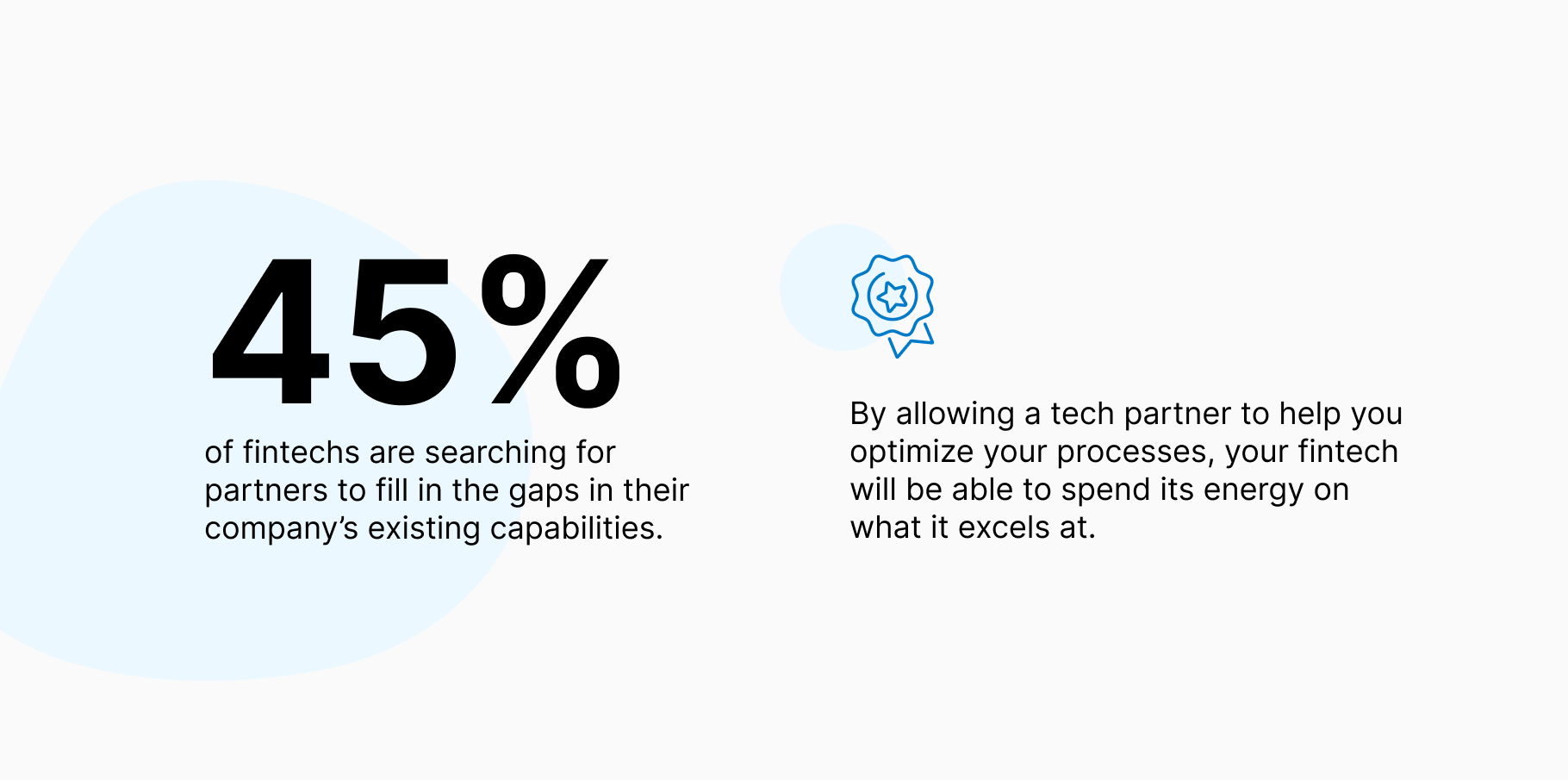

In fact, 45% of fintechs are searching for partners to fill in the gaps in their company’s existing capabilities. By allowing a tech partner to help you optimize your processes, your fintech will be able to spend its energy on what it excels at.

When choosing your potential partner, ensure that they have demonstrable specialist experience and knowledge in the latest high-tech innovations driving the sector’s fast growth, such as AI. For example, UK-based challenger bank Tandem partnered up with intive in order to implement cutting-edge technologies such as machine learning, predictive analytics, and cloud computing into their processes. This helped them guarantee a highly effective and secure development of the bank’s platform.

In addition to the company’s high level of tech knowledge, it’s also important to consider whether they have a strong grip on the fintech sector itself and where the industry is headed. Can they provide past or present case studies of other partnerships they've taken on in the fintech and financial services sector?

Agility and Flexibility

Fintech is often heralded as the antidote to the inflexibility of the traditional banking sector but this doesn’t mean fintechs are immune to agility challenges along the way. A tech partner with a strong agile mindset could help you stay flexible, which is critical for quickly pivoting when faced with the fluctuating conditions of the current market.

Look for partners with expertise in API integrations, microservices, and cloud-based technologies that enable the products you create together to be easily adjustable and scalable. This goes for early-stage startups as well as established fintechs, whether it’s ensuring that an agile mindset is embedded into the company and its digital products from the beginning or tackling those outdated legacy systems that are no longer fit for purpose.

In fact, established fintechs outsource more across the board than their younger counterparts, stemming from the need to operate with the agility that startups often can. For instance, British fintech Pockit has partnered with intive since 2016, benefitting from our expert digital services to develop a cloud-based solution to guarantee resilience and scalability in Pockit’s application as it grows.

Third-party partnerships can also provide flexibility in the way of working by tapping into a pool of tech talent from around the globe. This ensures that there is technical support available across different time zones. This team can also be scaled up and down when needed and is often a more time and cost-effective strategy compared to recruiting, training, and retaining entirely in-house. Having these specialized experts and all of their cutting-edge resources at your fingertips helps to shorten the development period and speed up time to market.

Risk and Regulation

Businesses often hesitate to involve third parties due to concern about the security of their data and intellectual property. This is particularly prevalent in the fintech sector which handles a great deal of sensitive financial information of its customers.

However, this shouldn't put you off from partnering up altogether.It’s simply a question of selecting your tech partner carefully. Ensure that they have robust security protocols in place and correct documentation and compliances, such as ISO certification. You should also establish from the start that they are willing to come up with a risk management plan with you.

While there is no universal fintech regulation framework, the more the sector develops, the more regulated it’s becoming. Your tech partner should not only be well versed in the laws but also be able to provide project examples and positive client reviews to prove their reliability. In fact, the correct tech partner should actually help you regulate and minimize risk, not increase it. Moorwand’s 2021 report found that 100% of survey respondents agreed that compliance is one of the biggest benefits of outsourcing.

User Centricity

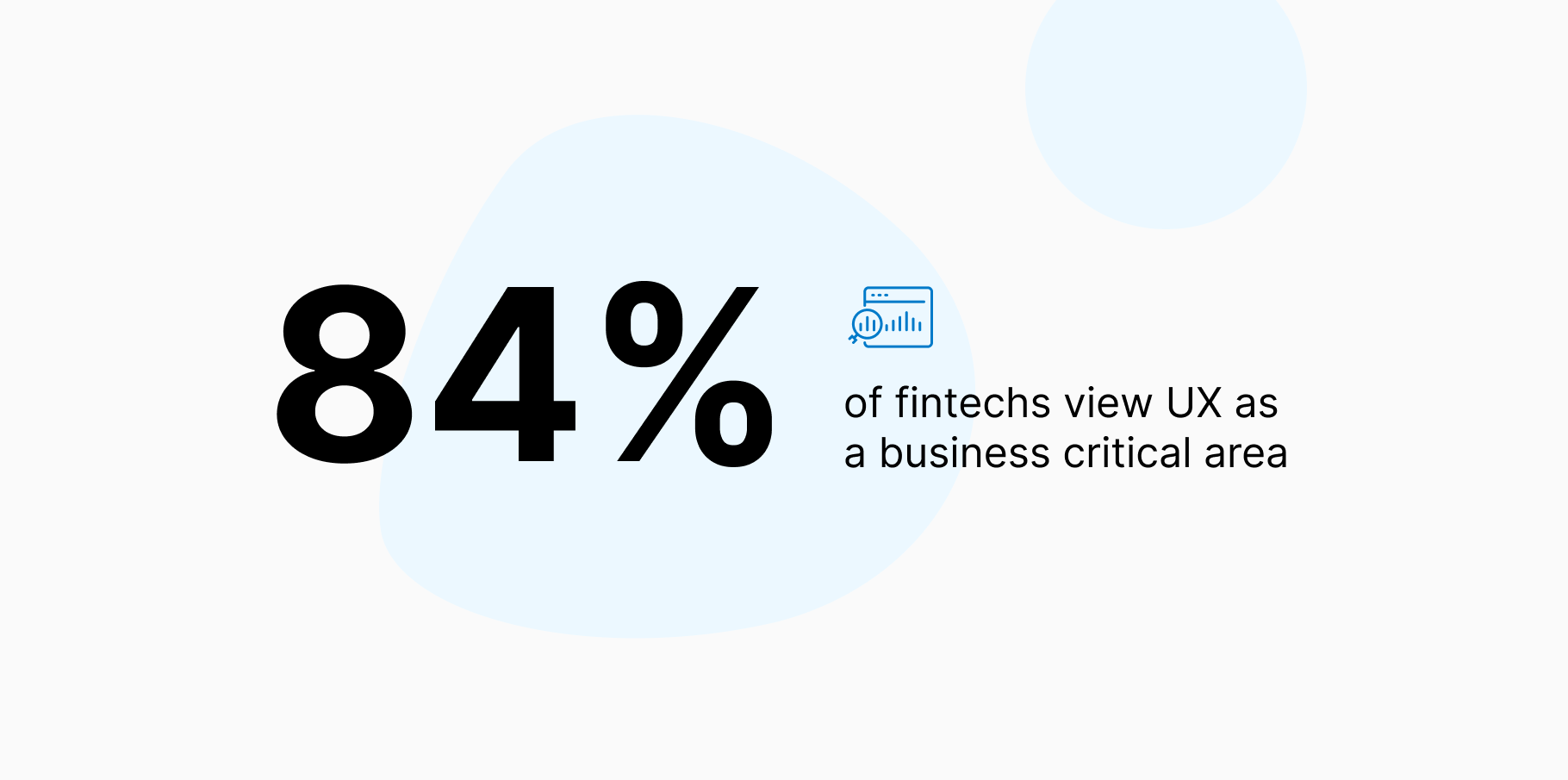

The fintech industry’s success is not only due to its ability to help the sector be safer, but also more user-centric. Fintechs have revolutionized user experience in banking. In the beginning their products were purely functional tools used for money transfer and now they completely transform the customers’ relationships with their finances. Great UX holds the power to help customers access and understand their finances in a simple, meaningful, and enjoyable way. In fact, almost half of the surveyedfintechs outsource user experience, and 84% view this area as “business critical”.

A tech partner could support you with user testing and uncovering your customers’ pain points, or in providing excellent UX design capabilities that match your business goals. They may also take the role of UX lead that guide your team through every step of the research, design, testing and delivery process, providing strategy and consultation.

A partner that always prioritizes the needs of the end user is crucial. At intive, we have a human-centric approach to engineering which combines our extensive user research capabilities, UX design expertise, and use of cutting-edge technologies. Partnering with us means tapping into our talented team of over 100 designers that use our design-led approach to create unforgettable digital experiences for your end users.

A Final Word...

Embarking on a tech partnership doesn’t mean that you’re handing over valuable parts of your business to a third party and giving up control and responsibility. Choosing a partner who provides you with invaluable specialized expertise, security, and agile technologies and teams will make it feel a lot more like a collaboration than outsourcing.

At intive, we pride ourselves on our partnerships with over 25 fintech clients. We get to exchange our expertise, skills, and knowledge which ultimately make our businesses and teams stronger. Our human-centered approach to engineering means we always have the end-users’ needs top of the mind and are committed to exceeding their expectations with an exceptional fintech product. Finally, we make collaborative decisions at all stages of the partnership, coming together as one team with a single goal: to create impactful and exciting digital products.