//5 min

As more businesses switch to digital-only payments and processes, nearly one-third of adults worldwide remain unbanked. While technical innovation can certainly benefit society, we have to ensure that the evolution doesn’t leave behind people who aren’t part of a formal bank.

The pandemic already spurred the need for people to be able to pay for utilities, purchase goods, and conduct essential daily transactions online. At the same time, the crisis highlighted gaps in digital literacy and connectivity in underserved countries. In order to ensure that more people are brought into the financial fold, technology has had to accommodate more diverse user needs and market conditions, and make finance accessible to everyone.

Why is financial inclusion important?

Beyond the ethical responsibility of tech, financial inclusion has the potential to support countries’ growth – and is positively associated with GDP increases in developing economies in particular. Tech-driven financial inclusion can additionally empower communities by promoting financial stability via alternative financing, education about wealth building, and greater transparency in banking systems.

Here’s how technology can, and is, shaping a more inclusive financial sphere.

Financial inclusion means access to safer, smarter payment services

In regions like Latin America and across Africa, countries are heavily reliant on cash transactions. Paying with physical money, however, can be dangerous for the communities that have to keep large sums on them, and who have no documented paper trails for their purchases. At a broader level, the lack of financial tracking opens the doors to corruption.

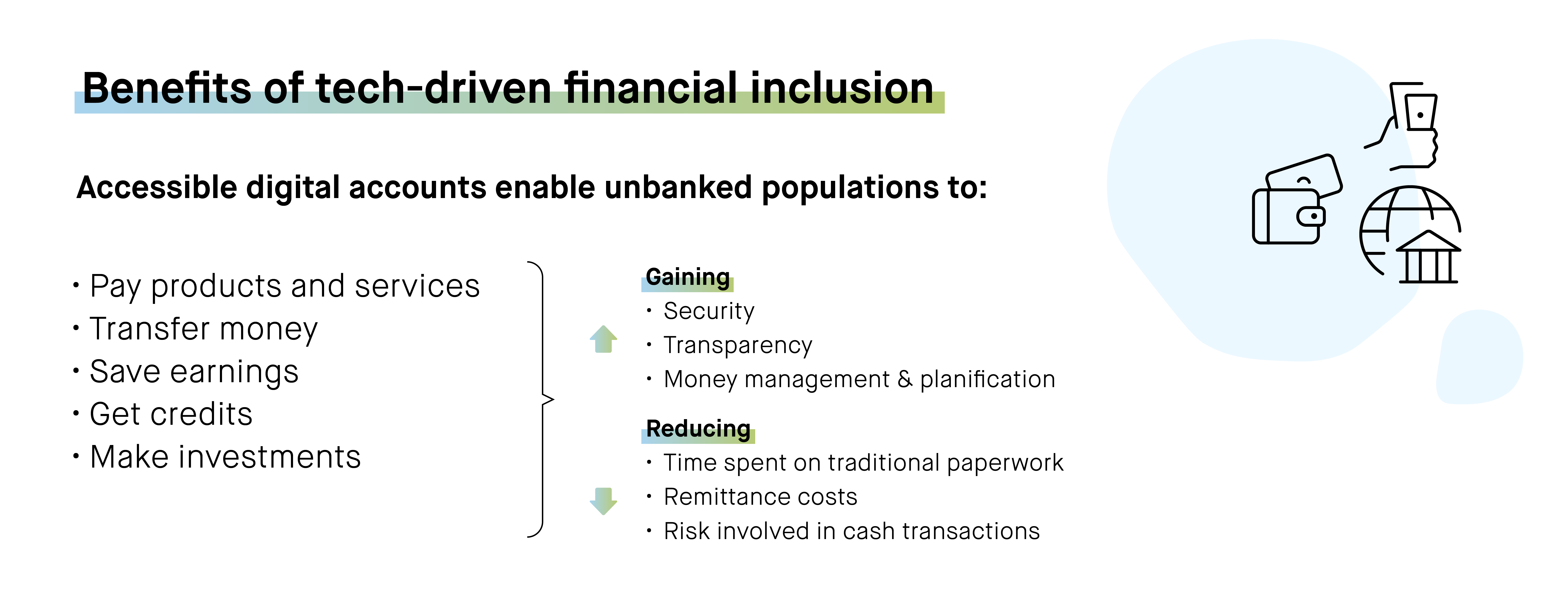

Interestingly, internet penetration is high in both Latin America and parts of Africa, and smartphone use is also common. With this backbone, mobile financial technology lets people create digital accounts to pay for goods, transfer money, and save. This type of tech not only reduces the number of cash transactions, but it also enables more communities to securely and quickly manage their money.

For example, Nubank in Latin America offers checking and savings accounts that can be opened in minutes to the public. Unlike traditional banks, these accounts don’t come with maintenance or overdraft fees. The company also launched a credit card product in Brazil in response to the country’s high interest rates and low level of trust in traditional banks. By providing affordable, accessible accounts to communities, Nubank now has more than 70 million users throughout Brazil, Colombia, and Mexico.

In Europe, intive partnered with UK-based Pockit, a fintech with prepaid spending cards, checking accounts, and financial services for customers that can’t access traditional banks. intive helped Pockit develop its flagship product on Microsoft Azure, ensuring secure integration with payment providers and being able to quickly address changing user needs. The outcome was faster, simpler, and better protected customer journeys – meaning people can open accounts in a matter of minutes and stay atop of their finances 24/7.

Check out fintech software development services we offer our clients.

Tech-driven financial inclusion has had to factor in remittances too, as one billion people worldwide rely on them. While traditional banks can charge between 7-20% of the sum being transferred, one report shows that mobile tech can cut remittance costs in half. That means that people (especially from emerging markets) can send a large portion of their remittance money to relatives overseas. Meanwhile, tech tools like PayPal and Xoom make sending money cheaper, faster, and traceable.

A springboard for businesses to grow

Tech-driven financial inclusion bridges the wealth gap in populations and generates economic growth and opportunity for both individuals and organizations. For instance, small businesses often aren’t eligible for credit from traditional financing institutions because they’re perceived as higher risk. New and small companies in developing markets face even more barriers to financing.

In response, fintechs are creating alternative pathways to credit for SMEs. Peer-to-peer (P2P) lending platforms allow lenders to make a bid for borrower’s loan requirements, and then borrowers can accept or reject the offer. In this scenario, the P2P platform acts as a connector and coordinator for loan agreements that small businesses otherwise may not have been able to finalize.

In Mexico, Konfio provides digital banking, payments, and software tools to boost small and mid-sized enterprises. The financial services platform gives entrepreneurs up to $3,000,000 MXN (around $162,000 USD) as business credit, based on a data-driven assessment. What’s more, credit can be sent in a one-day turnaround, whereas traditional lenders can take months to approve a request and typically demand collateral.

Besides financing, technology helps low-income entrepreneurs during economic difficulties. During the pandemic, governments in Peru, Zambia, Uganda, and Namibia used a variety of digital services to distribute emergency funds to businesses. Had these services not been available, entrepreneurs would not have received crucial financial support to continue business operations and stay afloat.

Overcoming financial pitfalls, together

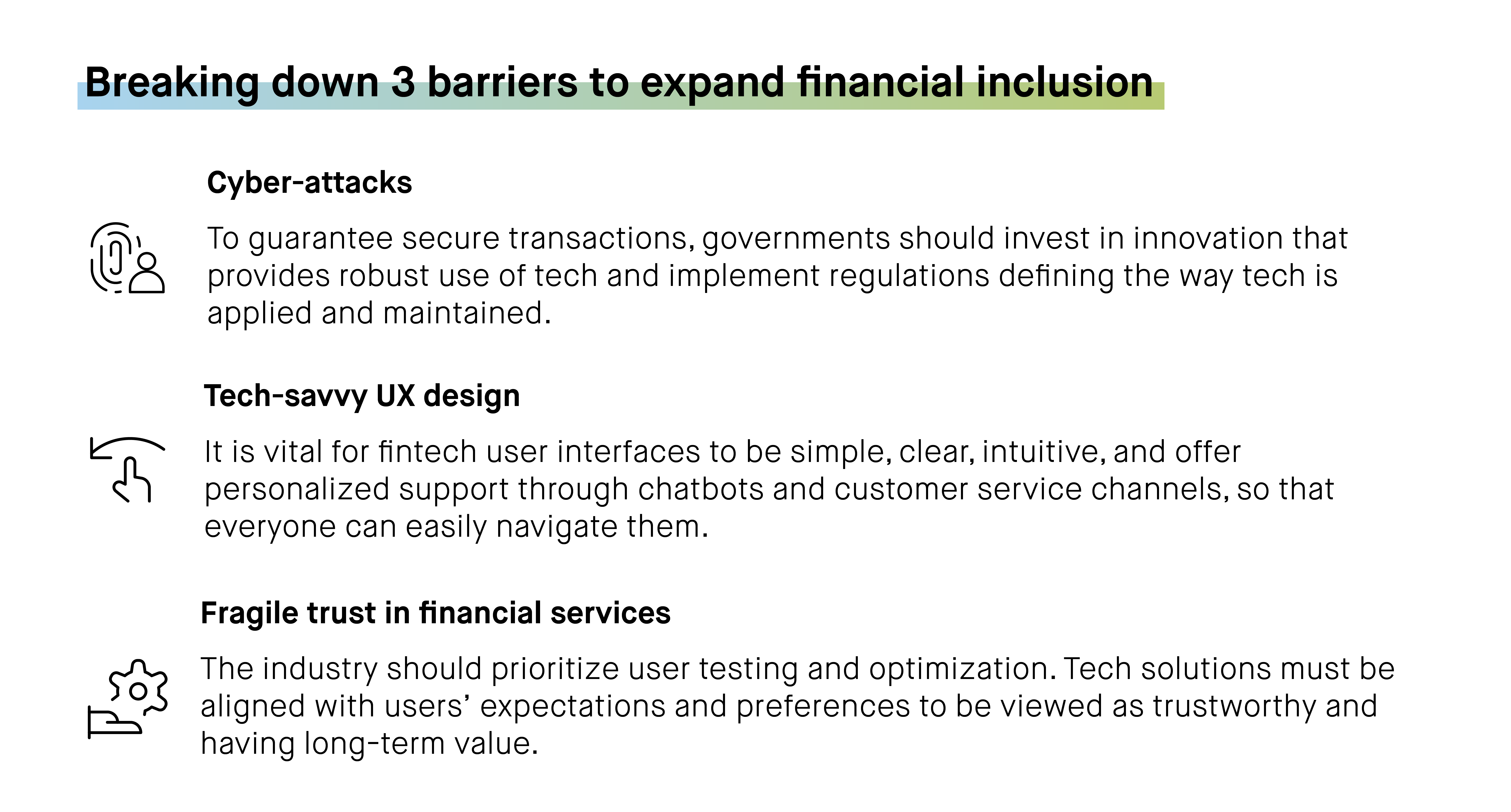

Technology is making huge strides toward greater global financial inclusion, however, there remains a journey ahead. Three main areas of focus have to be cybersecurity, inclusive design, and trust-building.

The finance sector is the most targeted for cyber attacks. Many unbanked communities also live in countries that have poor digital protections, so don’t have the technical infrastructure to guarantee secure transactions facilitated by new technology. In this context, people and their money are put at risk – accounts can be hacked, data can be exposed, and transactions can be interrupted.

To overcome these threats, governments need to invest in innovation that establishes the robust use of tech, for example, open access infrastructure and API use. Likewise, governments should work in tandem with fintechs to implement regulation that defines how (and by whom) tech is applied and maintained. Initiatives like ‘Know Your Customer’ and anti-money laundering regulations should be a baseline for any nation using tech to drive financial inclusion, and these should be updated regularly to reflect changes in fraudulent and criminal methods.

Elsewhere, fintech UX has to be curated with underbanked users in mind. At the moment, tools are predominantly built for tech-savvy audiences, but this undermines efforts to expand financial inclusion. To ensure that everyone can easily understand and navigate tech, the user interface should be simple – applying clear language and intuitive design. It should also have personalized support, where chatbots and customer service channels are readily available to guide users.

Financial inclusion: summary

Trust in financial services both online and offline is fragile, and mistakes can be costly as people who have a bad experience will immediately churn. As tech powers mass financial services, the industry has to prioritize user testing and optimization. Especially for people making a big leap from being unbanked, tech solutions must align with their expectations and preferences in order to be viewed as trustworthy and having long-term value.

Tech-driven financial inclusion isn’t a band aid approach to an important social issue – it’s a strategy to include people in safe, shrewd money management, for good. Research tells us that people with financial knowledge are more likely to invest and make sound risk assessments around their finances, and fintech can supply such knowledge as well as facilitate day-to-day transactions.

Beyond just making payments easier, technology is striving to make financial inclusion an inherent characteristic of the modern world.